Investor Relations

FAQ

Corporate and share information

Q1. When was Tokyo Gas established?

A. Our company was established on October 1, 1885.

Q2. When was Tokyo Gas listed on the Tokyo Stock Exchange?

A. It was listed on the TSE in May 1949.

Q3. On what stock exchanges is Tokyo Gas listed?

A. We are listed on the First Section of the stock exchanges in Tokyo, and Nagoya.

Q4. What sorts of companies belong to the Tokyo Gas Group?

A. Please see the page listing the members of our Group.

Q5. What is Tokyo Gas' return policy to shareholders?

A. Please see Shareholder's Returns.

Q6. What is your securities code?

A. 9531

Q7. What are the trading units for your stock?

A. Hundred shares.

Business activities

Q1. What is the difference between natural gas, city gas, LNG, and LPG?

A. Natural gas is a type of fossil fuel, like oil and coal. It is a combustible gas mainly composed of methane (CH4). As it is lighter than air and does not contain carbon monoxide, it is safer than gas that is mainly composed of propane.

City gas refers to gas that is generally supplied and sold over a broad area from an LNG receiving terminal (a plant that manufactures city gas through the regasification of LNG brought in on tankers) or from an extraction area. Gas sold by Tokyo Gas is classified as city gas.

LNG stands for liquefied natural gas and it is natural gas that has been turned into liquid after extraction by cooling it down to temperatures of around -162℃. Liquefied gas is about 1/600th of the volume of regular gas, so it is ideal for transporting by tanker. LNG is the main raw material for city gas.

LPG stands for liquefied petroleum gas and its main components are propane and butane. When producing city gas, high-calorie LPG is added to LNG in order to maintain a set calorific value.

Q2. Please tell us about the "Tokyo gas Group's Management Vision Compass2030" announced in November, 2019.

A. Please refer to the "Compass2030".

Q3. What are some characteristics of city gas business in Japan?

A. Japan is a mountainous landscape where there are a few areas where the population and industry are concentrated in such a way as to be advantageous to gas suppliers. For this reason, only about 6% of Japan's land are networked with city gas supply.

Although about 200 city gas companies compete in this limited geographical area, three large companies account for about 80% of the total gas sales volume: Tokyo Gas, Osaka Gas, Toho Gas. In addition to city gas suppliers, there are about 1,400 community gas utility suppliers and 17,000 liquefied petroleum gas (LPG) suppliers, most of which are small or medium-sized firms. The resource for approximately 90% of the city gas in Japan is natural gas, almost all of which is imported in the form of liquefied natural gas (LNG). Only a few companies import and regasify LNG to supply city gas. Unlike the United States and Europe, Japan does not have a nationwide pipeline network; each city gas company maintains a network of pipelines in its service area through which it supplies and markets gas.

Q4. Please describe recent trends in liberalization.

A. Regarding the deregulation of the gas industry, revisions were made to the Gas Business Act in June 2015 and these went into effect in April 2017. For the main details of these revisions, please see Deregulation of the Electric Power and Gas Markets.

Q5. How does Tokyo Gas procure LNG?

A. Tokyo Gas currently imports LNG from ten projects in six countries. Unlike oil, which is found only in certain parts of the world, natural gas is available globally. This makes it possible to diversity the risk and ensure stable procurement by trading with geographically diverse producers in Southeast Asia, Australia, the Middle East, Russia and other locations with competitive contract terms and conditions.

Going forward, we will continue striving to make our LNG procurement more competitive by further diversifying producers, and this includes plans to procure from new projects. LNG transactions generally involve signing long-term sales and purchase agreements, and we have considerable negotiating power based on the prospect of steady demand growth in our market, which will help us to realize flexible and stable LNG procurement. We will also expand our LNG trading (swaps, etc.) by leveraging the assets we possess such as LNG carriers and terminals, power plants, and procurement agreements, to realize transactions with business partners that capitalize on our respective strengths.

Q6. On what assumptions does Tokyo Gas base its projections for gas sales volumes?

A. Regarding demand from residential accounts and the like, Tokyo Gas estimates the number of customers using macroeconomic indicators, such as population trends, the number of housing starts and building starts. This number is multiplied by the average volume used per customer, factoring in increases from efforts to sell gas appliances. In the deregulated market---primarily large-volume customers-sales representatives in charge of individual users, such as factories and large buildings, ascertain the facility-operating rate for each location, and determine when customer facilities would be due for replacement. Based on this information, Tokyo Gas compiles a gas sales volume plan for each large-volume customer as well as estimates for sales to new customers. We then obtain our final plan by adding the figures from each market segment.

Q7. Please tell us about market risk exposure.

A. Tokyo Gas discloses external risks concerning business development that may have a significant effect on investment decisions and the principal risks with which management should be involved. Forward-looking statements contained herein are based on assessments of Tokyo Gas as of the end of the latest consolidated fiscal year.

For more information: Management Risk

Q8. What steps are being taken to prevent corporate scandals?

A. We have built a compliance structure and internal control system, creating the means to prevent the occurrence of any such scandals. In addition, the Management Ethics Committee, composed of members of the top management, conducts regular checks of the measures we are taking, and we have a compliance structure that functions cross-sectionally throughout the Group, including affiliates.

Q9. How do you develop the power generation business?

A. We will leverage our strengths to expand our electrical power business in order to contribute to solving electricity supply and demand issues. We regard the following attributes as our the key strengths.

1. Competitive fuel procurement based on our strong negotiating position

2. Full use of our existing infrastructure of LNG terminals and other facilities, and the siting of power plants adjacent to the centers of demand

3. Synergistic effects for our gas business stemming from the increase in usage rates of LNG terminals, one-stop sales, etc.

We have five power plants currently in operation or planned, which will provide a combined generation capacity of 3.6 MW.

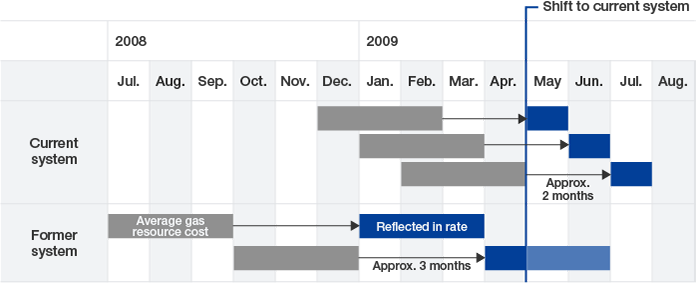

Q10. What is the gas rate adjustment system?

A. The price of LNG imported into Japan is strongly linked to crude oil prices and the price of LNG (Liquefied Natural Gas) and LPG (Liquefied Petroleum Gas) which make up gas resource costs are influenced by crude oil price and exchange rate fluctuations. A system is in place that adjusts the unit cost (1m3 units) of gas resource costs in accordance with factors such as these crude oil price and exchange rate fluctuations. The gas rate adjustment system enables changes in gas resource costs due to external factors, such as crude oil price and exchange rate fluctuations, to be swiftly reflected in gas rates. It was introduced in January 1996 to make gas rates more transparent and clarify the efforts of gas suppliers to increase management efficiency.

Q11. What is the impact on revenues and expenditures of fluctuations in exchange rates and crude oil prices?

A. Changes in gas resource costs, such as the price of LNG (Liquefied Natural Gas) and LPG (Liquefied Petroleum Gas), due to crude oil price and exchange rate fluctuations are swiftly reflected in gas rates based on gas rate adjustment system, which lowers the risk of fluctuating revenues and expenditures. However, in some cases the timing of the payment of gas resource costs and the timing of the recouping of gas rates may fall in different fiscal years, having an impact on revenues and expenditures in an individual fiscal year. This is referred to as the “sliding time lag effect.”

However, these differences in timing disappear when taking a long-term perspective, so we consider the impact on management to be neutral. These fluctuations are included in our financial results announcements, so please see the tables outlining sensitivity to changes at the end of the most recent results presentation materials.

Q12. What do you mean by “LNG value chain”?

A. This refers to how Tokyo Gas maximizes added value through integrated business development that spans from the development of natural gas resources through to the procurement and transportation of gas, the production of city gas, power generation, and even the sale of energy and gas appliances and the provision of services and energy solutions to customers. Tokyo Gas engages in business that ranges from upstream to downstream through this LNG value chain approach.

Q13. What do you mean by “energy solutions”?

A. These are solutions that we propose and deliver to customers in regard to a variety of energy issues, such as efficient energy use and cost reductions. Examples of energy solutions include the sale of ENE-FARMs, fuel shifts, and the provision of energy services.

Q14. What kind of product is an ENE-FARM?

A. An ENE-FARM is a residential fuel cell system. The system generates electricity through a chemical reaction between hydrogen contained in gas and oxygen. The heat produced by this reaction can also be utilized.

Q15. What do you mean by “fuel shift”?

A. This refers to a shift by consumers currently using fuels such as heavy fuel oil to city gas. We plan to increase the volume of our industrial gas sales through this process.

Q16. What is energy service business?

A. Energy service providers construct and retain ownership of the gas cogeneration systems and other energy facilities they employ on customer sites for the provision of one-stop energy solutions. Potential customers are increasingly attracted to the benefits of energy services, which include energy cost savings increased environmental responsibility and virtually no initial outlay. The profitability of this business is also improving, as the systems themselves are made more efficient - a trend that promises a bright future for this emerging new business.

We will engage in efficient business operations by leveraging our capabilities in LNG procurement and advanced engineering to realize the best mix of energy appliance and systems, with a focus on gas cogeneration systems, to target environment-conscious consumers, particularly in the Kanto area where there is huge potential demand.

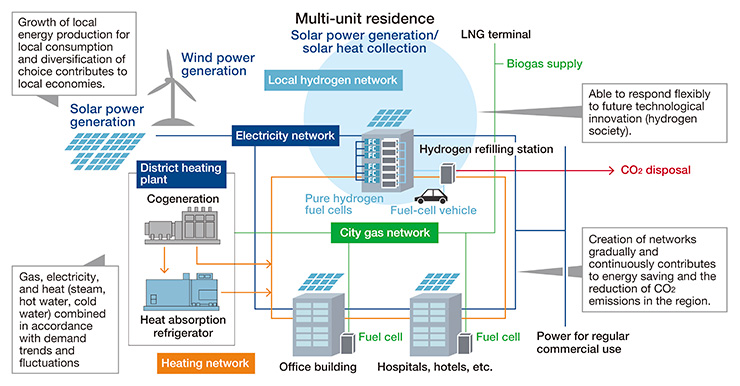

Q17. What kind of system is a “distributed energy system”?

A. Distributed energy system refers to the small-scale generation of electricity to meet local demand. As there is no transmission loss and the steam and hot water produced during generation can be used to avoid waste, these systems offer high total energy efficiency, save energy, and reduce CO2 emissions. Gas cogeneration systems and ENE-FARM residential fuel cell systems are examples of these.

Q18. What is the smart energy network concept?

A. These are network systems that realize an optimum supply of heat and electricity to multiple consumers by not only distributing the electricity and heat produced by combining cogeneration and renewable energy to multiple consumers, but also distributing this using information and communications technology. This balances consumer comfort, the reduction of CO2 emissions, and energy conservation across an entire society.

In order to realize a low carbon society, the use of environmentally friendly natural gas will increase in the future as it becomes central to comfortable, eco-conscious lifestyles.

Financial information

Q1. When is the next announcement of financial results?

A. Please see IR Calendar

Q2. How can I find the latest information about the company's business results?

A. Please see Earnings Announcements materials.

Requests for corporate materials

Q1. What can we do if we want to ask for corporate materials?

A. Please request them by clicking here Contact Us and completing the inquiry form.