Investor Relations

Policy and Structure

Basic views on corporate governance

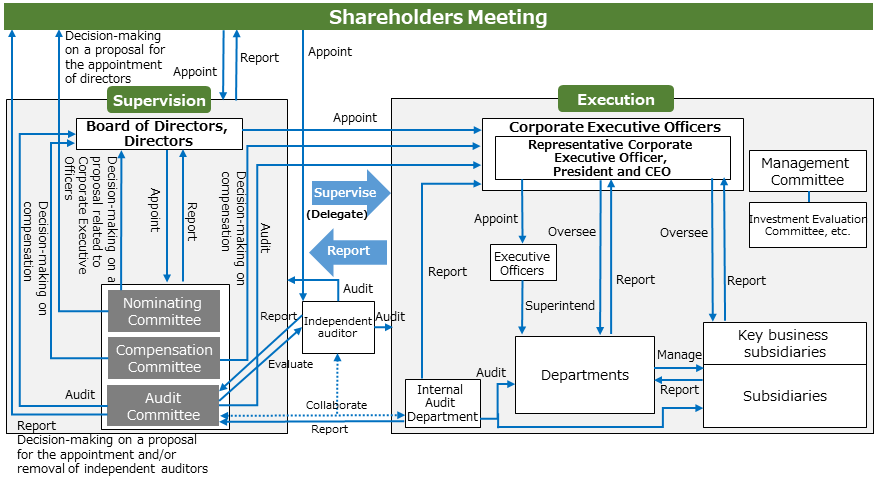

Based on our Management Philosophy, we ensure legality, soundness, and transparency in management; clarify the responsibilities of management and execution; strengthen supervisory and auditing functions; and promote accurate, timely decision-making and efficient business operations, thereby enhancing and reinforcing corporate governance.

Implementation System of Corporate Governance

Following approval of the 221st shareholders meeting, Tokyo Gas has made a transition to a "Company with a Nominating Committee, etc." and has established three committees (Majority of members and a chairperson of each committee are outside directors): a Nominating Committee to determine director candidates and recommend corporate executive officer candidates; an Audit Committee to audit execution of duties by directors and corporate executive officers; and a Compensation Committee to determine remuneration for directors and corporate executive officers.

The Board of Directors (Executives) determines management policies, supervises execution of duties by corporate executive officers, delegates decision-making concerning important matters for business execution to corporate executive officers, and receives reports on the status of the execution, when needed.

Corporate executive officers are required to contribute to appropriate, prompt decision-making and to ensure efficient business operations by taking up in a committee (generally meeting weekly) that supports the corporate executive officers' reasonable decision-making matters to be submitted to the Board of Directors and other important managerial matters.

Executive officers are assigned responsibility for ensuring prompt business operations by corporate executive officers. Tokyo Gas has thus adopted and established a governance structure that ensures high legality, soundness, and transparency.

Corporate Governance Structure

Corporate Governance System (As of June 27, 2025)

| Number of Directors (of those, number of Independent Outside Directors*1) | 9 (6) |

|---|---|

| Number of Corporate Executive Officers*2 | 4 |

| Number of Executive Officers | 27 |

-

*1:All six Outside Directors have been reported to the stock exchange as independent officers in accordance with the Company's

"Criteria for Determining the Independence of Outside Directors." -

*2:Includes a Corporate Executive Officer who concurrently serves as Director (Representative Corporate Executive Officer, President and CEO).

Composition and role of the Board of Directors

As a company with a Nominating Committee, etc., to enable the Board of Directors to perform its supervisory functions more effectively, only one Director concurrently serves as a Corporate Executive Officer—the Representative Corporate Executive Officer, President and CEO. This clearly separates execution and supervision, ensuring attentive and disciplined management. On this basis, approximately two-thirds of the Board of Directors are Outside Directors, placing diverse and objective oversight at the core of Board operations.

In principle, the Board of Directors meets once a month to make important management decisions, including on management plans and policies, in accordance with laws, the Articles of Incorporation, and the Regulations of the Board of Directors. Authority for business execution decisions is largely delegated to the Representative Corporate Executive Officer, President and CEO, to enable faster management, while monitoring from a comprehensive management perspective to enhance corporate value.

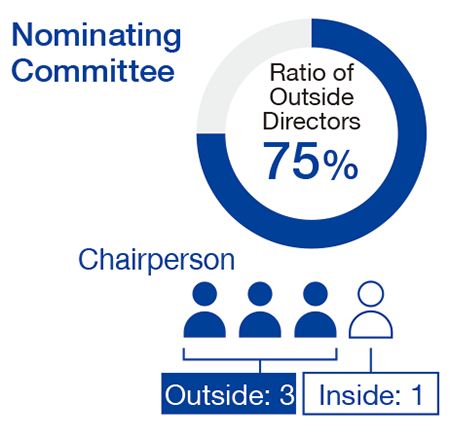

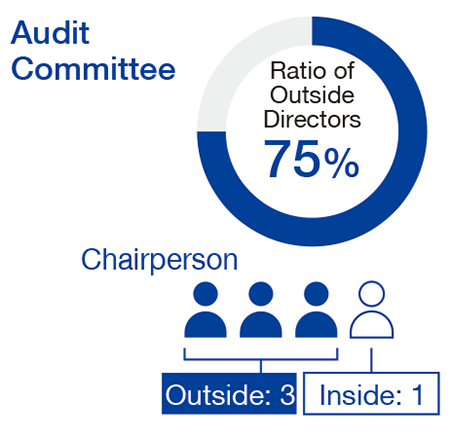

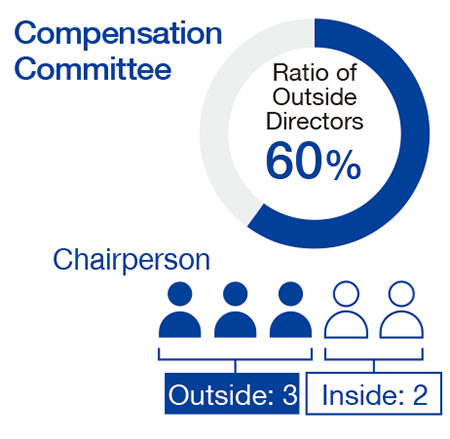

Composition and role of Committees

Each committee is composed of members selected from among the Directors by resolution of the Board of Directors, with a majority being Outside Directors, and the chairperson is an Outside Director.

The Nominating Committee determines the content of proposals for the appointment and dismissal of Directors submitted to the shareholders' meeting, as well as the content of proposals for the appointment and dismissal of Executive Officers submitted to the Board of Directors.

The Nominating Committee determines the content of proposals for the appointment and dismissal of Directors submitted to the shareholders' meeting, as well as the content of proposals for the appointment and dismissal of Executive Officers submitted to the Board of Directors.

The Audit Committee conducts audits of the execution of duties by Directors and Corporate Executive Officers, decides on audit reports, and determines proposals related to the appointment, dismissal, or non-reappointment of the independent auditor.

The Audit Committee conducts audits of the execution of duties by Directors and Corporate Executive Officers, decides on audit reports, and determines proposals related to the appointment, dismissal, or non-reappointment of the independent auditor.

The Compensation Committee establishes policies on individual remuneration for Directors and Corporate Executive Officers and, in accordance with these policies, determines the details of individual remuneration.

The Compensation Committee establishes policies on individual remuneration for Directors and Corporate Executive Officers and, in accordance with these policies, determines the details of individual remuneration.

Skills and roles demanded of Directors

- All of our Directors are expected to possess the following skills: knowledge to deepen corporate management, a mindset to drive corporate transformation, and the ability to ask questions that address corporate challenges.

- For Outside Directors, we expect them to possess the skills necessary to oversee the achievement of the Group's management vision, Compass 2030, and to complement the knowledge and experience of internal Directors and Corporate Executive Officers.

- All internal Directors, except for the Representative Corporate Executive Officer, President and CEO, serve as non-executive Directors and are responsible for providing proposals and information in a timely and appropriate manner to ensure the effectiveness of the Board of Directors.

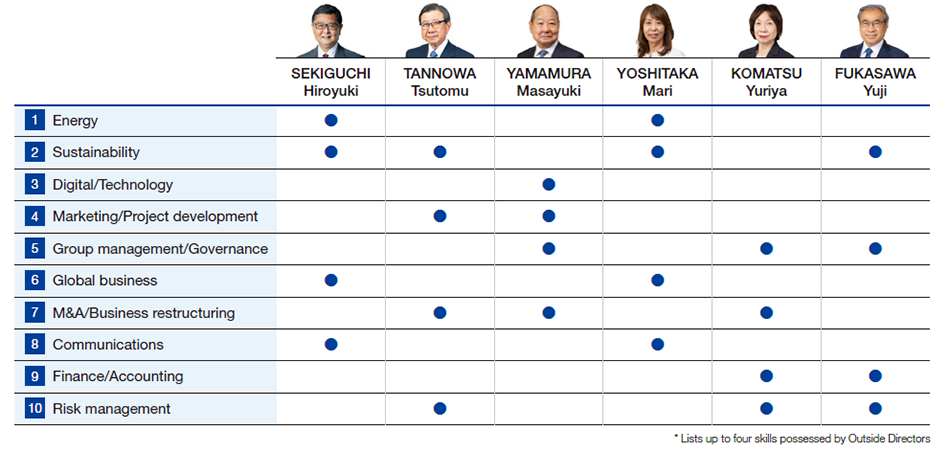

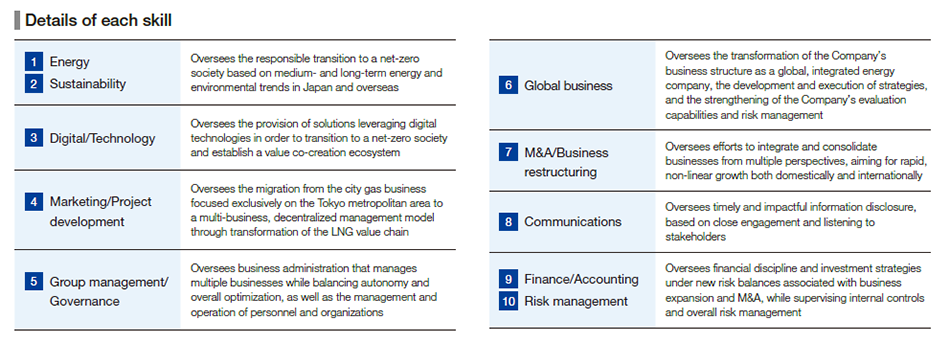

Skills matrix for Outside Directors

Skills (up to four) held by Outside Directors are as follows:

The reason for appointment of outside directors

| SEKIGUCHI Hiroyuki |

Mr. SEKIGUCHI Hiroyuki's keen perception, deep discernment in approaching the heart of matters, and great skills at presentation from the TV viewer's perspective concerning the overall economy including energy and sustainability, which he developed through his experience as a TV journalist and senior commentator, will greatly contribute to the promotion and supervision of the Company's management strategies. |

|---|---|

| TANNOWA Tsutomu |

Mr. TANNOWA Tsutomu's management abilities based on his broad view and in-depth knowledge he has acquired as a corporate executive of a chemicals manufacturer, and knowledge on governance, especially his business sense from a risk perspective developed through management reforms and business restructuring, will be very useful in the promotion and supervision of the management strategy which the Company aims for. |

| YAMAMURA Masayuki |

Mr. YAMAMURA Masayuki's management ability based on a broad perspective and deep insight cultivated as an executive in an infrastructure company, combined with extensive experience in organizational and business restructuring and M&A, particularly broad knowledge and skills in digital and marketing, which the Company aims to strengthen, will be very useful in the promotion and supervision of the management strategy which the Company aims for. |

| YOSHITAKA Mari |

Ms. YOSHITAKA Mari's advanced expertise and communication skills in environmental business and sustainable finance cultivated as a consultant in the environmental and financial fields, along with extensive experience in decarbonization-related businesses both domestically and internationally, which the Company seeks to expand, will be very useful in the promotion and supervision of the management strategy which the Company aims for. |

| KOMATSU Yuriya |

Ms. KOMATSU Yuriya's advanced knowledge and analytical skills in finance, management and governance, risk management, M&A, and other areas as an analyst and advisor at domestic and international investment firms and IT-related companies, along with a management perspective honed from a risk standpoint as an outside director for multiple companies, will be very useful in the promotion and supervision of the management strategy which the Company aims for. |

| FUKASAWA Yuji |

Mr. FUKASAWA Yuji's management abilities based on a broad perspective and deep insight cultivated as an executive in an infrastructure company, especially his diverse knowledge and experience in sustainable group management and governance developed through management reforms, organizational restructuring, and institutional redesign, along with a risk-oriented management perspective, will be very useful in the promotion and supervision of the management strategy which the Company aims for. |

Improving the effectiveness of the Board of Directors

The Board of Directors reviews the performance of specific initiatives based on the results of the previous evaluation and analyzes and assesses the overall effectiveness of the Board, taking into account evaluations provided by each Director through questionnaires.

In FY2024, we commissioned a third-party evaluation by an external organization and conducted individual interviews with all Directors based on the results of a questionnaire. Drawing on the evaluations by each Director, the findings identified in the third-party evaluation, and the opinions of the Directors, the Board of Directors discusses future initiatives. We will continue to enhance this PDCA cycle to further improve the effectiveness of the Board.

<FY2024 third-party evaluation>

The effectiveness of the Board of Directors is generally secured and supported by the following strengths:

- Continuous efforts toward governance reform

- Robust executive structure

- Open information sharing with the Board of Directors

To further enhance effectiveness, the following areas are expected to be addressed:

- Greater contribution of Outside Directors within the monitoring model

- Further sophistication of Board operations

- Enhanced content and quality of materials and explanations

<FY2024 effectiveness evaluation>

Based on the issues identified through the third-party evaluation and other assessments, the Board of Directors discussed these points and aligned on the approach to Board monitoring.

Approach to Board monitoring

・ Matters resolved by the Board of Directors, such as the Group's management policies and business plans, are discussed multiple times. After resolution, the Board monitors progress toward the goals set in the medium-term and annual business plans.

・ Each Director contributes to improving the quality of management by speaking from diverse perspectives based on their experience, knowledge, and skills, while maintaining a bird's-eye view of overall management and a medium- to long-term perspective.

・ The Board of Directors, while taking care not to engage in micromanagement, aims to both exercise a checking function over bold proposals from the executive team and support executive initiatives to take appropriate risks, such as restructuring the business portfolio and making growth investments.

・ By appropriately applying these "accelerator and brake" mechanisms, the Group aims to achieve sustainable growth and enhance corporate value over the medium to long term.

<Key initiatives for FY2025>

The Board will conduct focused discussions in preparation for the formulation of the next Medium-term Management Plan and approve it. As a monitoring board, the Board will oversee each business, focusing primarily on investment effectiveness.