Investor Relations

Key Management Indicators

Profitability and Growth

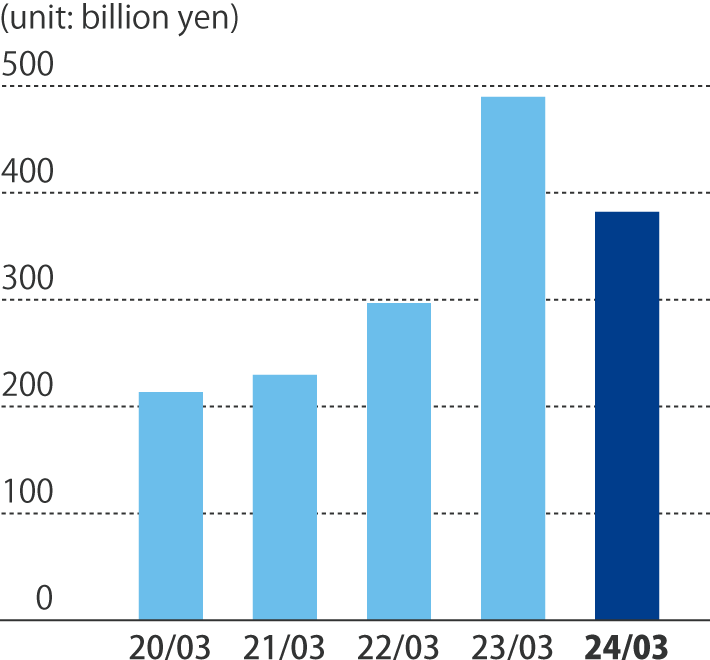

Operating cash flow

Operating cash flow

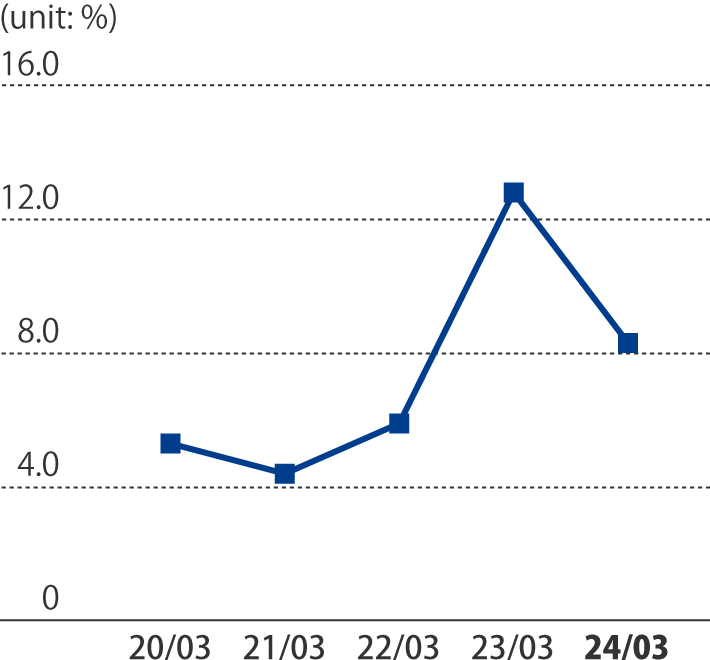

Operating Profit Margin

Operating Profit Margin

Definition

(unit: billion yen)

2021.3 |

2022.3 |

2023.3 |

2024.3 |

2025.3 |

|

|---|---|---|---|---|---|

| Operating cash flow | 229.3 | 296.6 | 490.2 | 379.3 | 342.4 |

| Capital expenditures | 246.4 | 207.2 | 213.2 | 205.2 | 320.7 |

| Depreciation* | 179.8 | 200.9 | 209.3 | 213.8 | 268.2 |

Definition 1 Operating cash flow = net Profit + amortization of long-term prepaid expenses + depreciation

* Depreciation includes amortization of long-term prepayments

(unit: %)

2021.3 |

2022.3 |

2023.3 |

2024.3 |

2025.3 |

|

|---|---|---|---|---|---|

| Operating Profit Margin | 4.4 | 5.9 | 12.8 | 8.2 | 5.1 |

| Net Profit Margin | 2.8 | 4.4 | 8.5 | 6.2 | 2.8 |

Efficiency

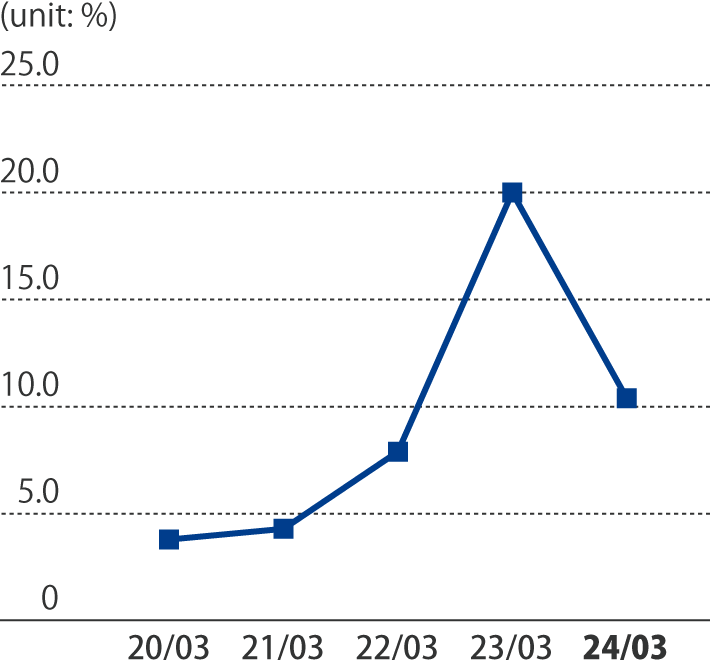

ROE (Return On Equity)

ROE (Return On Equity)

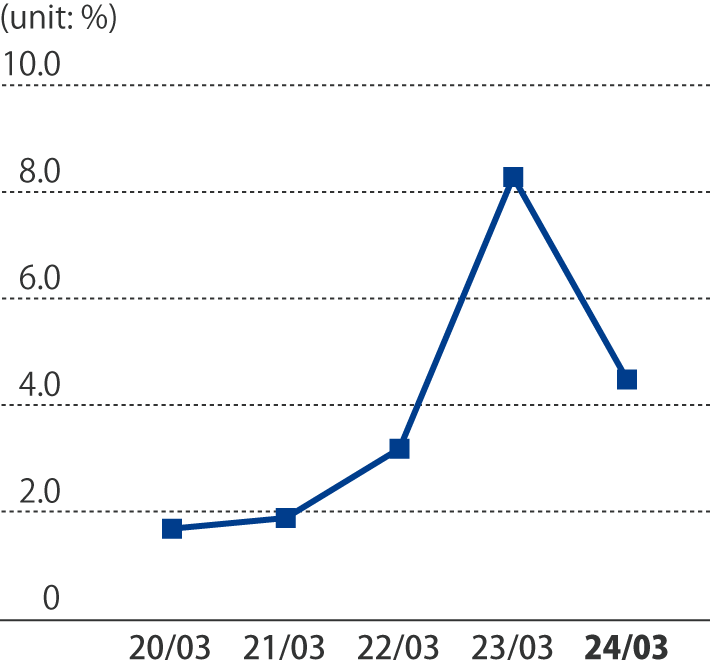

ROA (Return On Asset)

ROA (Return On Asset)

Definition

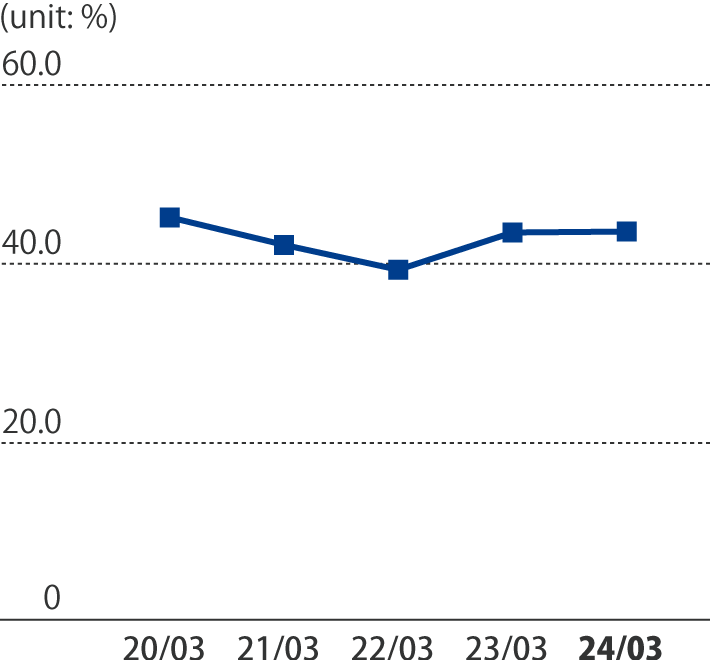

(unit: %)

2021.3 |

2022.3 |

2023.3 |

2024.3 |

2025.3 |

|

|---|---|---|---|---|---|

| ROE (Return On Equity)* | 4.3 | 7.9 | 20.0 | 10.2 | 4.3 |

| ROA (Return On Asset)* | 1.9 | 3.2 | 8.3 | 4.4 | 1.9 |

Definition 2 ROE = net profit / total equity (average of positions at start and end of fiscal year)

Definition 3 ROA = net profit / total assets (average of positions at start and end of fiscal year)

* ROA, ROE for FY2023 (March 31, 2024) is after retrospective application of the U.S. GAAP (Tokyo Gas America and its consolidated subsidiaries)

Soundness

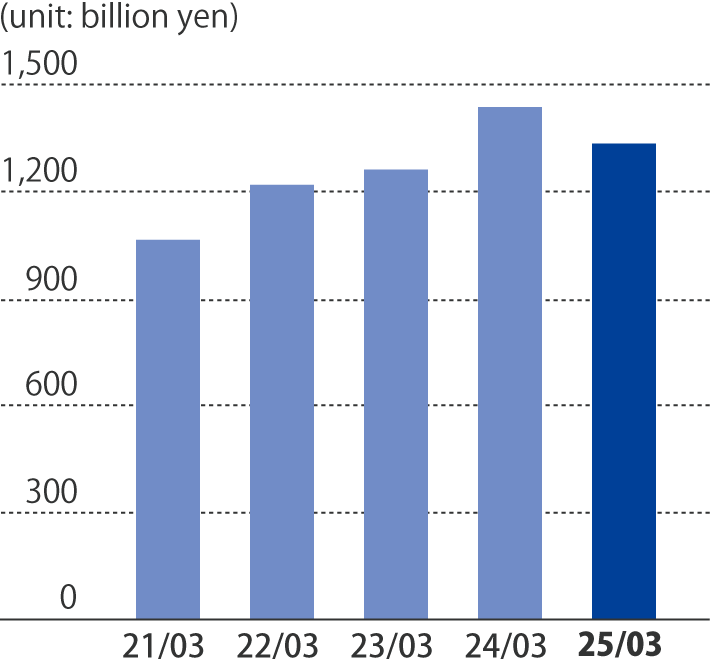

Interest-bearing debt

Interest-bearing debt

Equity ratio

Equity ratio

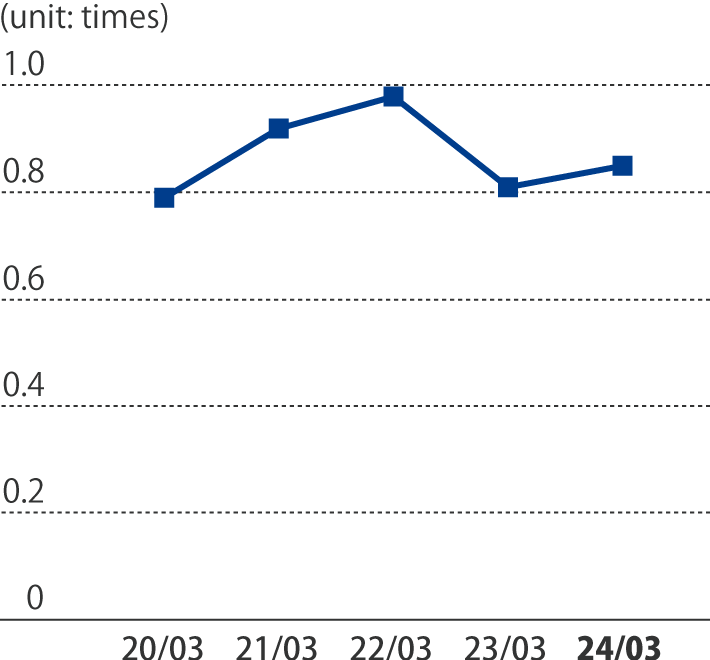

D/E ratio

D/E ratio

Definition

2021.3 |

2022.3 |

2023.3 |

2024.3 |

2025.3 |

|

|---|---|---|---|---|---|

| Interest-bearing debt (billion yen) | 1,065.9 | 1,220.5 | 1,263.2 | 1,439.2 | 1,336.2 |

| Equity ratio (%) | 42.1 | 39.3 | 43.5 | 43.4 | 44.8 |

| D/E ratio (times) | 0.92 | 0.98 | 0.81 | 0.85 | 0.77 |

Definition 4 Equity ratio = equity (year-end) / total assets (year-end) x100

Definition 5 Debt-equity ratio = interest-bearing debt (year-end) / total shareholders' equity (year-end)

Performance Indicators

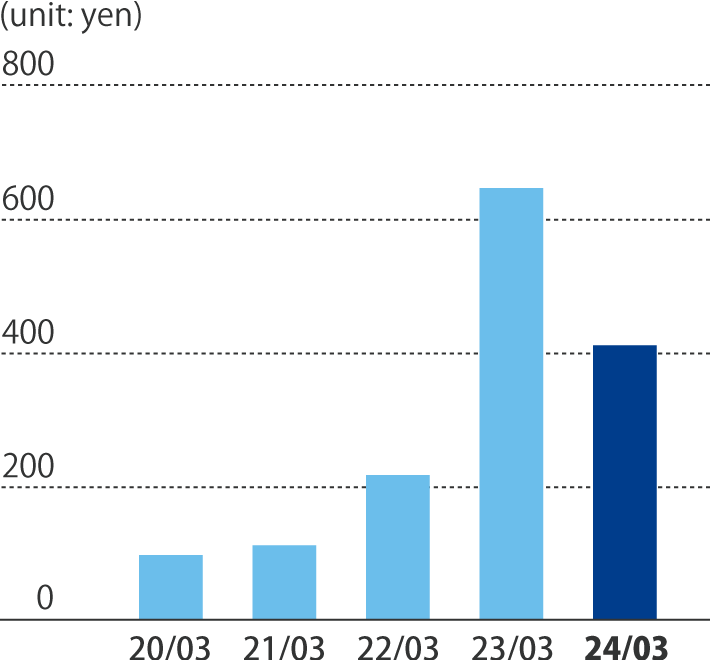

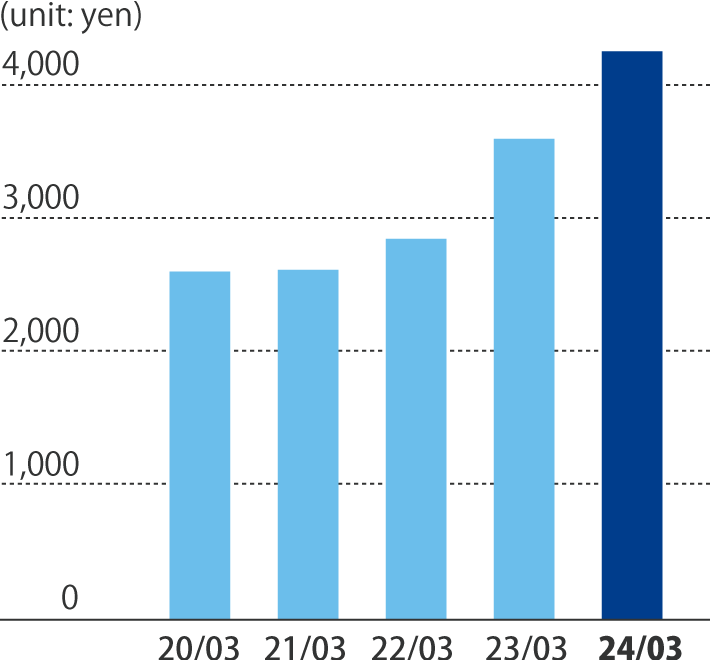

EPS (Earnings per Share, adjusted for latent shares)

EPS (Earnings per Share, adjusted for latent shares)

BPS (Book Value per Share)

BPS (Book Value per Share)

Definition

(unit: yen)

2021.3 |

2022.3 |

2023.3 |

2024.3 |

2025.3 |

|

|---|---|---|---|---|---|

| EPS (Earnings per Share, fully diluted EPS) | 112.3 | 217.7 | 647.0 | 401.1 | 192.2 |

| BPS (Book Value per Share) | 2,616.4 | 2,847.9 | 3,595.6 | 4,244.1 | 4,669.4 |

| PER (Price Earnings Ratio) (times) | 21.94 | 10.25 | 3.86 | 8.75 | 24.78 |

| PBR (Price Book Value Ratio) (times) | 0.94 | 0.78 | 0.69 | 0.83 | 1.02 |

Definition 6 EPS = net profit/average number of issued shares

Definition 7 BPS = equity/number of issued shares (year-end)