Investor Relations

Key Management Indicators

Profitability and Growth

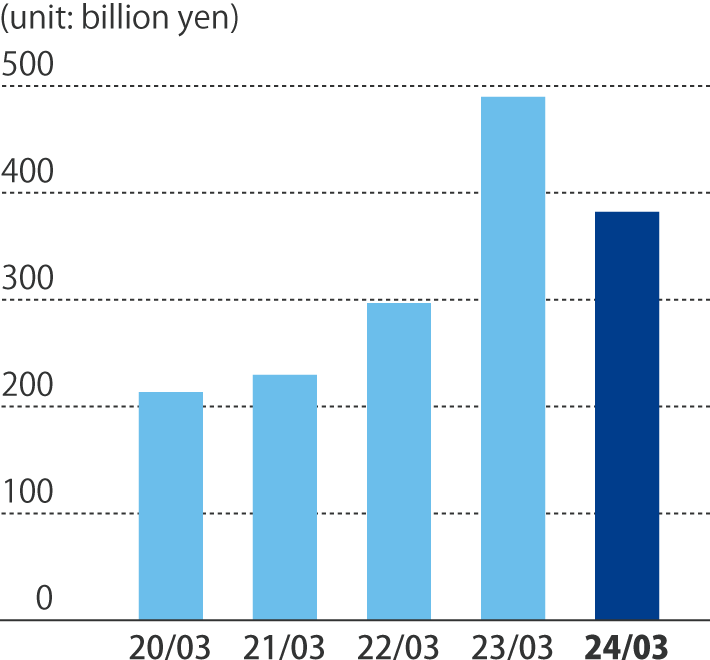

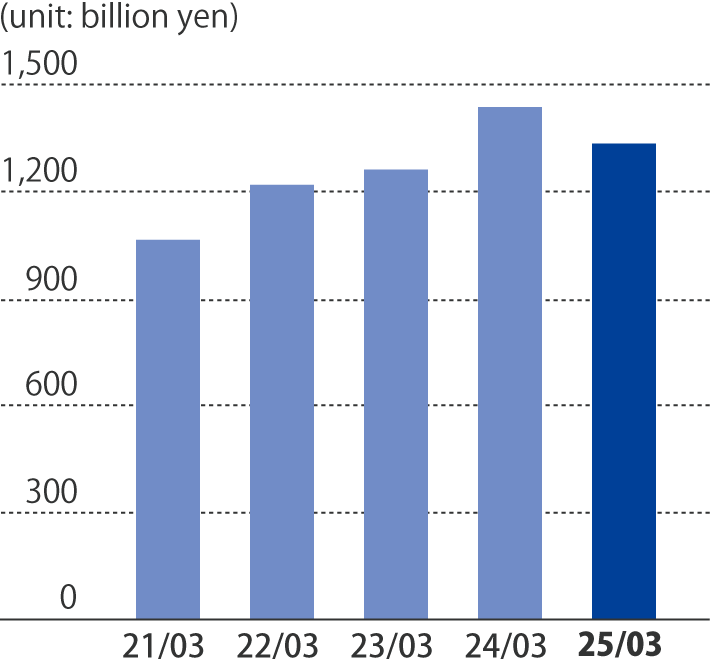

Operating cash flow

Operating cash flow

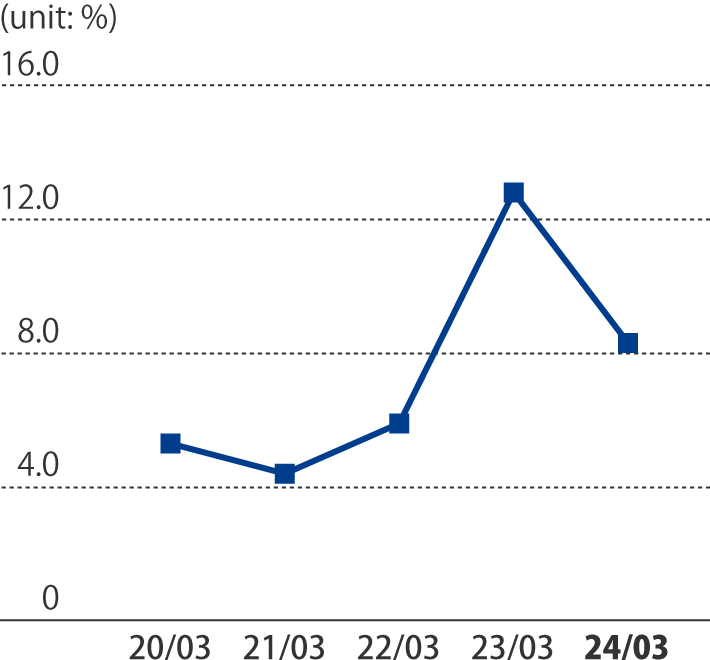

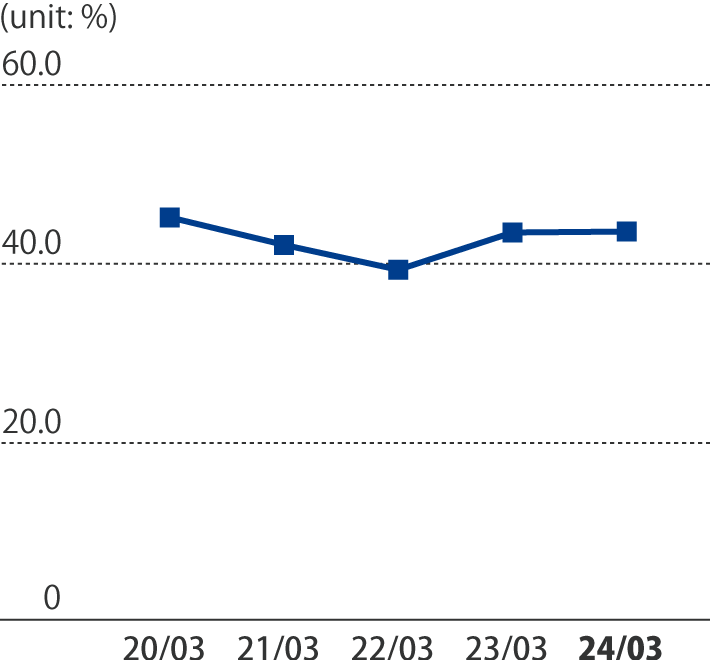

Operating Profit Margin

Operating Profit Margin

Definition

(unit: billion yen)

| For the years ended March 31 | 2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|

| Operating cash flow | 246.4 |

213.1 |

229.3 |

296.6 |

490.2 |

| Capital expenditures | 223.7 |

227.0 |

246.4 |

207.2 |

213.2 |

| Depreciation* | 161.8 |

169.8 |

179.8 |

200.9 |

209.3 |

Definition 1 Operating cash flow = net Profit + amortization of long-term prepaid expenses + depreciation

* Depreciation includes amortization of long-term prepayments

(unit: %)

| For the years ended March 31 | 2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|

| Operating Profit Margin | 4.8 |

5.3 |

4.4 |

5.9 |

12.8 |

| Return on Sales | 4.3 |

2.3 |

2.8 |

4.4 |

8.5 |

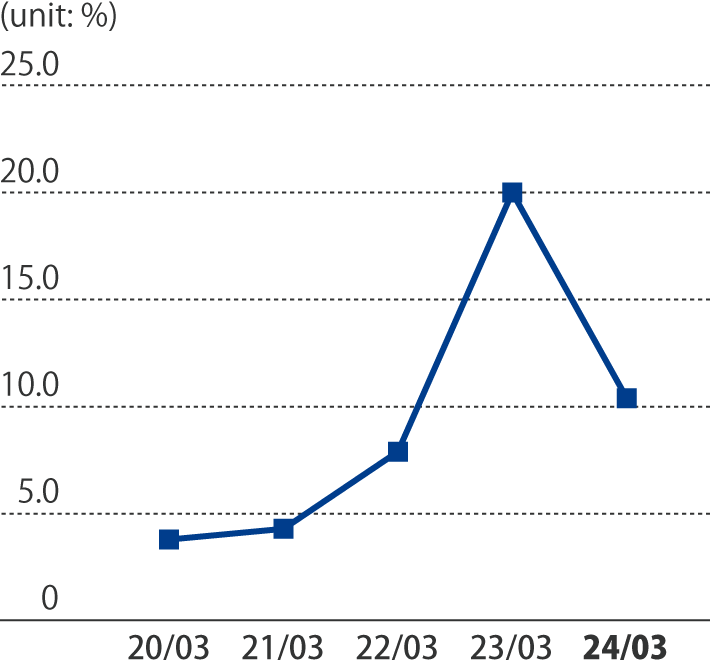

Efficiency

ROE (Return On Equity)

ROE (Return On Equity)

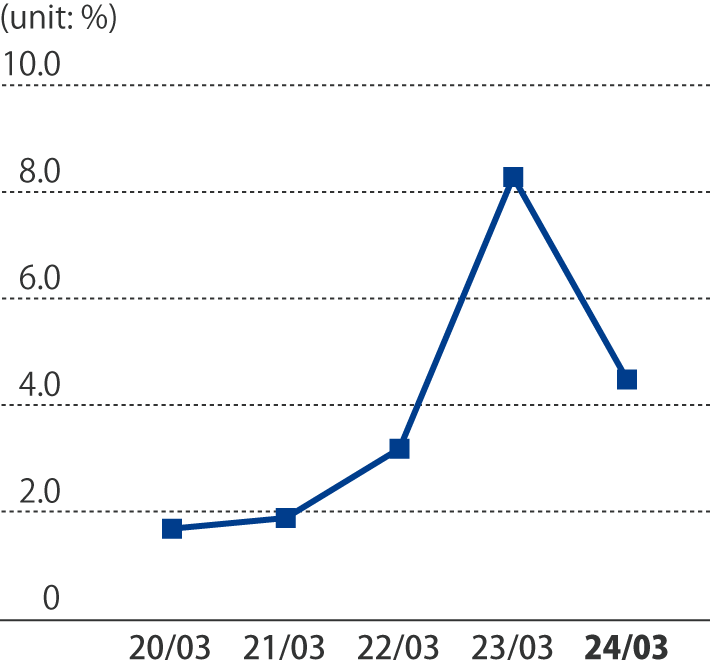

ROA (Return On Asset)

ROA (Return On Asset)

Definition

(unit: %)

| As of March 31 | 2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|

| ROE (Return On Equity) | 7.4 |

3.8 |

4.3 |

7.9 |

20.0 |

| ROA (Return On Asset) | 3.6 |

1.7 |

1.9 |

3.2 |

8.3 |

Definition 2 ROE = net profit / total equity (average of positions at start and end of fiscal year)

Definition 3 ROA = net profit / total assets (average of positions at start and end of fiscal year)

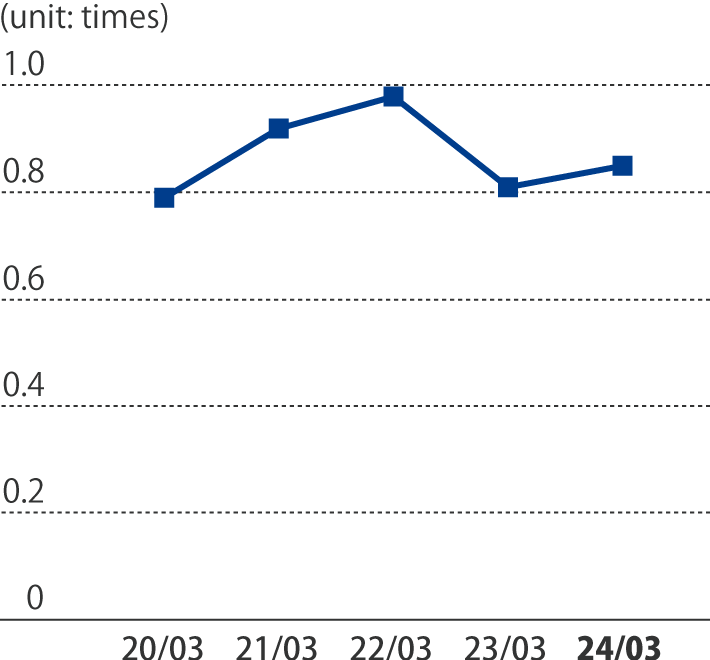

Soundness

Interest-bearing debt

Interest-bearing debt

Equity ratio

Equity ratio

D/E ratio

D/E ratio

Definition

| As of March 31 | 2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|

| Interest-bearing debt (billion yen) | 803.2 |

905.0 |

1,065.9 |

1,220.5 |

1,263.2 |

| Equity ratio (%) | 47.7 |

45.2 |

42.1 |

39.3 |

43.5 |

| D/E ratio (times) | 0.69 |

0.79 |

0.92 |

0.98 |

0.81 |

Definition 4 Equity ratio = equity (year-end) / total assets (year-end) x100

Definition 5 Debt-equity ratio = interest-bearing debt (year-end) / total shareholders' equity (year-end)

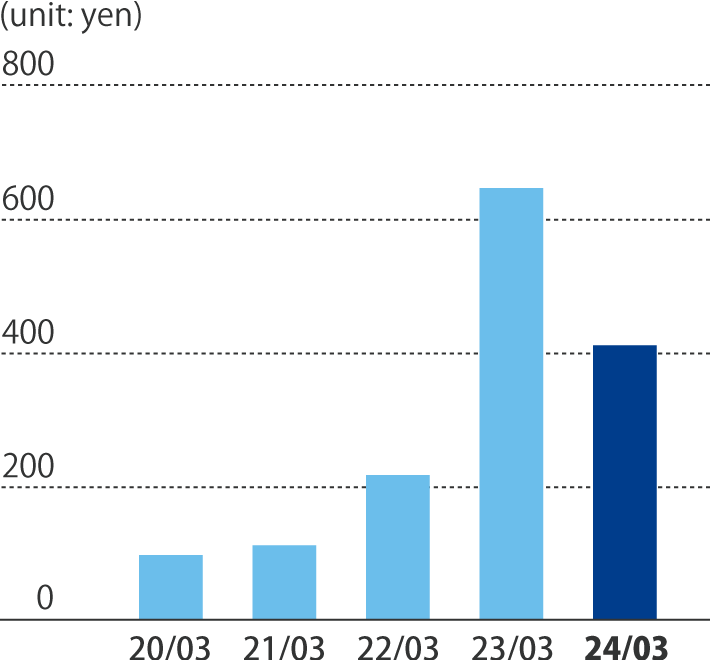

Performance Indicators

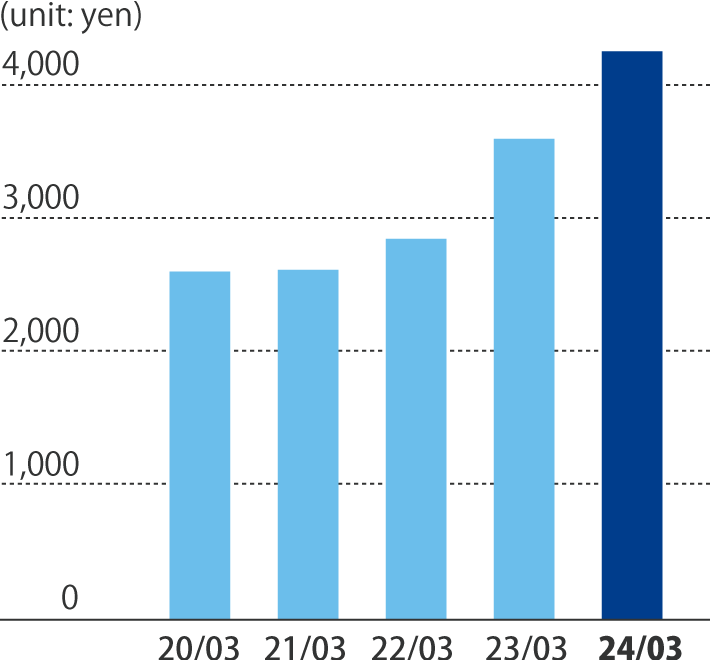

EPS (Earnings per Share, adjusted for latent shares)

EPS (Earnings per Share, adjusted for latent shares)

BPS (Book Value per Share)

BPS (Book Value per Share)

Definition

(unit: yen)

| As of March 31 | 2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|

| EPS (Earnings per Share, fully diluted EPS) | 187.6 |

97.9 |

112.3 |

217.7 |

647.0 |

| BPS (Book Value per Share) | 2,576.0 |

2,602.5 |

2,616.4 |

2,847.9 |

3,595.6 |

| PER (Price Earnings Ratio) (times) | 16.0 |

26.1 |

21.9 |

10.3 |

3.9 |

| PBR (Price Book Value Ratio) (times) | 1.2 |

1.0 |

0.9 |

0.8 |

0.7 |

Definition 6 EPS = net profit/average number of issued shares

Definition 7 BPS = equity/number of issued shares (year-end)

* As of October 1,2017, the company carried out a share consolidation at a ratio of 5 common shares to 1.